The latest figures from the Department for Work and Pensions (DWP) show there are now 12.6 million people across Great Britain receiving State Pension payments from the contributory benefit, which provides essential financial support every four weeks for those who have paid at least 10 years' worth of National Insurance contributions.

Some 9.7 million people are receiving payments of the Basic State Pension, which is worth up to £156.20 each week, compared to 2.9 million getting the New State Pension, worth up to £203.85 each week. Payments can be claimed by people who have reached the UK Government’s official retirement age, which increased to 66 for both men and women in October 2020 and is scheduled to rise to 67 between 2026 and 2028.

For anyone approaching the official age of retirement, it is important to be aware of certain benefits you can claim from the DWP plus discounts on Council Tax, help with heating costs and more.

To make it easier for people to understand and claim these benefits, discounts or reductions, the MoneyHelper website has compiled a comprehensive list along with quick eligibility checks to ensure older people are accessing essential support in later life.

The easiest way to check eligibility for any benefit, discount or reduction is to use an online benefits calculator - find out more about these here. If you have an older family member or friends who do not have access to the internet, or is not familiar with using a computer, give them a hand to ensure they are not missing out on additional financial support.

Benefits and discounts available in retirement include:

- State Pension

- Pension Credit

- Help with Council Tax

- Help with heating costs

- Health benefits

- Travel and TV benefits

- Benefits for war widows and widowers

State Pension

The State Pension gives you a regular taxable income for the rest of your life as soon as you reach State Pension age and make a claim for it. Some people choose to defer this while they continue to work.

It’s not means-tested, but the amount you get depends on how many qualifying years of National Insurance Contributions or credits you’ve built up. You need at least 10 years for any State Pension payment and 35 for the maximum amount - this may be more for people who were 'contracted out', find out more here.

State Pension weekly payment rates 2023/24

- Full New State Pension: £203.85

- Full Basic State Pension (Category A or B): £156.20

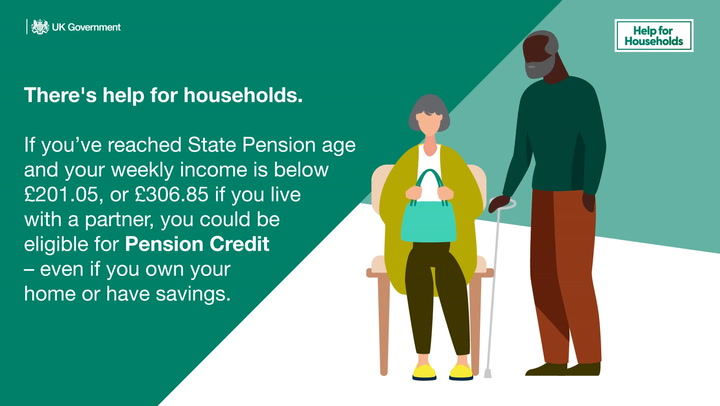

Pension Credit

Pension Credit currently gives 1.4million people across the UK - including more than 127,000 in Scotland - extra money to help with living costs if they are over State Pension age and on a low income. It is a ‘passport’ benefit providing on average more than £3,500 each year in financial support, acting as a ‘gateway’ to Council Tax, housing and NHS discounts along with free TV Licences for the over-75s.

Try the Pension Credit Calculator on GOV.UK for yourself or a family member to make sure you’re receiving all the financial support you are entitled to. You can also call the Pension Credit helpline on 0800 99 1234.

Help with Council Tax

Whether you own your home or rent, you could be eligible for support from your local authority to help you pay your Council Tax. Contact your local council to ask about support with Council Tax - find out more here.

Winter Fuel Payment

This is a tax-free payment of up to £300 to help people born before September 25, 1957 keep warm during winter. This year, payments are being boosted by up to £300 if you also qualify for the pensioner cost of living payment - find out more about this here.

The amount you get depends on your age and who lives in your household. If you’ve had the payment before, you should get it again without having to claim. You should also get it automatically if you meet the age and residence criteria, and get any of the wide range of benefits.

These include:

- State Pension

- Pension Credit

- Jobseeker’s Allowance

- Employment and Support Allowance.

If you qualify, you’ll get a letter confirming how much money you can expect to receive. Payments are usually made over November and December, but will continue until January 26, 2024.

The Winter Fuel Payment will be paid into your chosen bank account - usually where the State Pension is paid - the payment reference on your bank statement will be ‘DWP Winter Fuel’.

£55 Winter Heating Payment - Scotland only

This is a new annual, one-off payment of £55 from the Scottish Government which replaces the £25 Cold Weather Payment from DWP. Payments are due to start in the middle of September with the vast majority expected to be made by the end of January - find out more here.

£25 Cold Weather Payment - England and Wales only

This benefit from DWP has been replaced in Scotland by the new £50 one-off Winter Heating Payment.

Warm Homes Discount scheme

Certain people on a low income and getting means-tested benefits can get a deduction from their winter electricity bill through the Warm Homes Discount scheme - for the tax year 2023-2024 the discount is worth £150.

Find out about the rule changes that were implemented last year, eligibility and participating energy suppliers on GOV.UK here.

There are two ways to qualify:

- If you get the Guarantee Credit element of Pension Credit and your supplier is part of the scheme, you will normally get this deduction automatically from your bill

- If you’re on a low income, claim certain means-tested benefits and your supplier is part of the scheme you can also get this deduction

People on pre-pay or pay-as-you-go meters can also get the discount, but you will need to talk to your supplier about how to get it. Payments to your energy supplier should be made by March 31, 2024 for winter 2023/24.

Insulation and heating schemes

There are a number of schemes that install insulation and heating improvements to make your home more energy efficient. You’re likely to be eligible if your home is poorly insulated or doesn’t have a working central heating system, and if you receive any of a range of income-related benefits including Pension Credit.

Find out more from Home Energy Scotland here or by calling 0808 808 2282.

Health benefits

Everyone in Scotland is entitled to free prescriptions. Find out more about free dental treatment and refunds for travel to hospital appointments here.

Disability and care benefits

A number of benefits are available to people who have disabilities, long-term health conditions or specific care needs.

These benefits include:

- Personal Independence Payment (PIP) - if you’re under State Pension age, if you reached State Pension age while claiming PIP this will continue

- Adult Disability Payment - replacing PIP for people living in Scotland

- Disability Living Allowance (DLA) - you will need to have been already claiming this before you reached State Pension age

- Attendance Allowance - if you’re over State Pension age and have not claimed DLA or PIP

We have dedicated sections on the Daily Record website for each of these benefits:

Bus passes

People in Scotland qualify for a free bus pass when they reach 60. A new petition is calling for the free bus and coach travel to be extended to trains - find out more here.

Travel concessions

If you are over 60 or disabled find out about travel concessions on the Transport Scotland website here.

Free passport

If you were born on or before September 2, 1929, and are a British national, you could be eligible for a free passport. Find out more and how to apply on the GOV.UK website here.

Free / Discounted TV Licence

You now have to pay for your TV licence unless you are getting Pension Credit. People over State Pension age may be able to get the TV Licence for half price if they are registered as severely sight-impaired or blind.

Check out the Money Advice Service TV licence guide here to find out if you’re eligible.

Benefits for war widows and widowers

If your husband, wife or civil partner died or were injured or became ill as a result of their service in Her Majesty’s (HM) Armed Forces, or during a time of war before April 6, 2005, you might be entitled to a War Widow’s or Widower’s Pension.

If they died or sustained an injury or illness due to serving in a conflict after April 6, 2005, you might be entitled to compensation through the Armed Forces Compensation Scheme.

Find out more about War widows and widowers’ pensions and compensation on the GOV.UK website here.

Medical costs for war pensioners

If you need medical treatment because you were disabled while serving in the Armed Forces, you could get help towards your medical costs for your accepted disability.

Get the latest Record Money news

Join the conversation on our Money Saving Scotland Facebook group for energy and money-saving tips, the latest benefits news, consumer help and advice on coping with the cost of living crisis.

Sign up to our Record Money newsletter and get the top stories sent to your inbox daily from Monday to Friday, including a special cost of living edition on a Thursday - sign up here.

You can also follow us on X (formerly Twitter) @Recordmoney_ for regular updates throughout the day.

War Disablement Pension

If you were injured or disabled while serving in the Armed Forces before April 6, 2005, you can get extra help towards your pension. Find out more about War Disablement Pension on the GOV.UK website here .

Age Scotland also have a full list of benefits, discounts and support older people may be entitled to claim, find out more on their website here.

Join the Daily Record's WhatsApp community here and get the latest news sent straight to your messages.